You are here: Loan Activity > Loan Activity

LOAN ACTIVITY

Function

Process financial activity related to loans, including disbursements to the borrower, repayments from the borrower, and escrow payouts.

Process adjusting entries to correct loan histories.

Operating Instructions

From the GMS-RLSS Main Menu, select Loan Activity.

Function

Process financial activity related to loans, including disbursements to the borrower, repayments from the borrower, and escrow payouts.

Process adjusting entries to correct loan histories.

Operating Instructions

From the GMS-RLSS Main Menu, select Loan Activity.

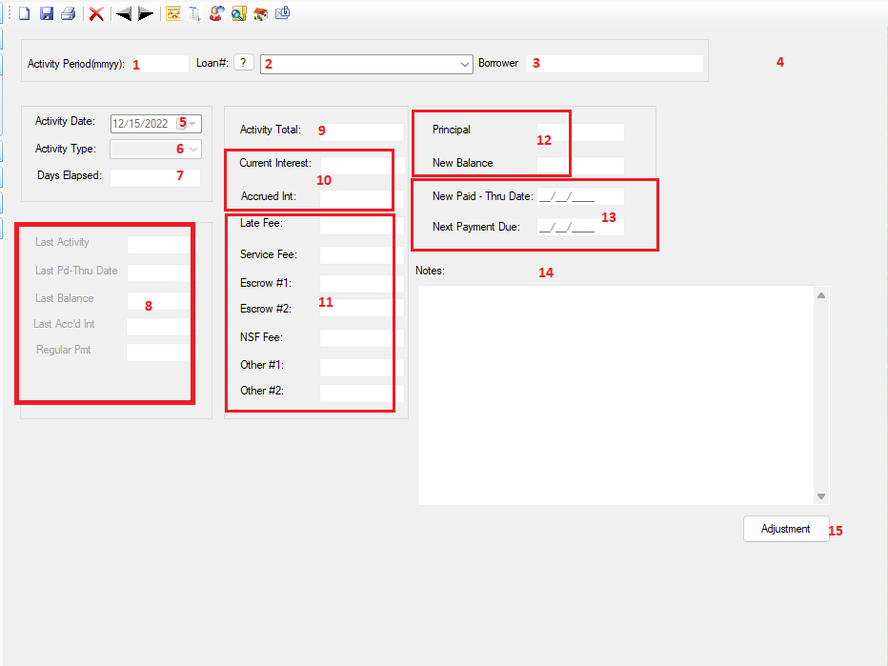

1.Activity Period

The purpose of an “Activity Period” is to allow activity that happens within an accounting period, usually a month, to be “batched” together. The Activity Period is identified by the month and year in which the activity being recorded took place. An example would be activity occurring within April, 2022, which should go into Activity Period 04/22. The screen will default to the current month and year based on the computer’s calendar and can be overridden if desired. Entry is made in the format of MMYY, with the slash being automatic.

2.Loan Number

Select the loan number from the drop-down menu, enter manually, or click on the “?” to receive a sortable listing of loan numbers, companies, last and first names. Click on column headings to sort ascending or descending order. Once located, double click on the row which will cause the sortable listing to disappear and the Loan # field to be populated with your selection.

3.Borrower

An automatic field displaying the borrower related to the loan number entered. This field cannot be edited. If the display is incorrect, verify the accuracy of the loan number.

4.Change Loan Status

The purpose of an “Activity Period” is to allow activity that happens within an accounting period, usually a month, to be “batched” together. The Activity Period is identified by the month and year in which the activity being recorded took place. An example would be activity occurring within April, 2022, which should go into Activity Period 04/22. The screen will default to the current month and year based on the computer’s calendar and can be overridden if desired. Entry is made in the format of MMYY, with the slash being automatic.

2.Loan Number

Select the loan number from the drop-down menu, enter manually, or click on the “?” to receive a sortable listing of loan numbers, companies, last and first names. Click on column headings to sort ascending or descending order. Once located, double click on the row which will cause the sortable listing to disappear and the Loan # field to be populated with your selection.

3.Borrower

An automatic field displaying the borrower related to the loan number entered. This field cannot be edited. If the display is incorrect, verify the accuracy of the loan number.

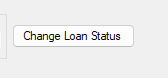

4.Change Loan Status

After entering a valid loan number, this button will appear. Clicking on it will allow the user to immediately change the Loan Status and Status Date in the Loan Master file. If Status Date is not necessary, remove the checkmark from the box next to the date, otherwise the current calendar date will be saved.

5.Activity Date

Select the Activity Date from the calendar or type in the appropriate date.

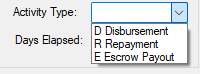

6.Activity Type

5.Activity Date

Select the Activity Date from the calendar or type in the appropriate date.

6.Activity Type

Select from the drop-down menu or enter D, R, or E as desired.

D = Disbursement: used to record disbursements of loan funds.

R = Repayment: used to record repayments from the borrower

E = Escrow: used to record escrow payouts on behalf of the loan

7.Days Elapsed

An automatic calculation of days that have passed since the Activity Date as it was recorded in the most recent activity. The calculation is derived by using the activity date as entered and comparing it to the activity date on the most recently recorded transaction. This field cannot be edited. If Days Elapsed seems inaccurate, verify the activity date is entered correctly. The field just below Days Elapsed is Last Activity and will show the date of the most recently recorded transaction.

8.Last Activity, Paid-Thru Date, Balance, Accrued Interest, Regular Payment and Interest Type (Daily/Amortized)

These fields cannot be edited as they reflect the activity from the most recently recorded transaction.

Last Activity: Activity date of the most recently recorded transaction.

Last Pd-Thru Date: The Paid-Thru date recorded in the most recent transaction.

Last Balance: The Loan Balance as of the most recently recorded transaction.

Last Acc’d Int: The total outstanding Accrued Interest as of the most recently recorded transaction.

Regular Pmt: The total Loan Payment, including Escrows and Service Fees as recorded in Loan Master.

Daily/Amortized: The method of interest calculation as entered in the Loan Master for the selected loan.

9.Activity Total

Enter the total amount of the disbursement, repayment, or escrow payout. Unless an adjusting entry is being made, Disbursements and Repayments are entered as positive numbers. (Please refer to Things You Should Know for information regarding adjusting entries.) Escrow payouts are entered as negative numbers under both Activity Total and the appropriate escrow field and should have no impact on the loan balance.

10.Current Interest and Accrued Interest

Current Interest:

An automatic calculation made in one of the following two ways:

Daily Interest Loans: If the loan has been established as Daily Interest within the Loan Master file, Current Interest is determined by multiplying the loan balance by the annual interest rate, dividing that amount by either 360 or 365 days (as documented in Loan Master) to determine a daily interest rate. The daily interest rate is multiplied by the Days Elapsed to determine the amount of Current Interest to be withheld from the repayment.

Amortized Loans: If the loan has been established as Amortized within the Loan Master file, Current Interest is determined by multiplying the loan balance by the annual interest rate, and dividing that amount by one payment cycle, usually one month. The payment cycle is determined by the entry made into “Payment Frequency” within the Loan Master.

Accrued Interest:

Accrued Interest is also an automatic calculation made by the program to account for interest due and uncollected as of the activity date.

Positive Accrued Interest results from one of the following situations:

Negative Accrued Interest occurs when the program collects outstanding accrued interest from a payment.

11.Late Fee, Service Fee, Escrow 1 & 2, NSF Fee, Other

These fields are to record various fees described below:

Late Fee: This amount is generally set up in Loan Master and will be calculated automatically based on that setup. See Loan Master for a full explanation of how Late Fees are set up.

Service Fee: This field is used to record any service fee applicable to the loan. This field will be calculated automatically if the Loan Master contains information within the field titled “Service Fee”. The service fee may also be entered manually, and an automatic service fee may be overridden if desired.

Escrow #1 and #2: These fields are used to record escrow funds applicable to the loan. If activity type is Repayment, and either of these fields is set up within Loan Master, the program will include this amount in the payment calculation. An escrow may also be entered manually, and an automatic escrow may be overridden if desired. If activity type is Escrow, enter a negative amount equal to the Activity Total.

Important Note: Escrow 1 Amt and Escrow 2 Amt within the Loan Master file have accompanying fields related to the maximum to be collected. The program will allocate repayment funds to escrow until the maximum is reached. Funds will no longer be collected until there is an escrow payout resulting in a reduced escrow balance. In some situations, an escrow account may not have a limit. Leaving the “maximum” field blank within the Loan Master will result in perpetual escrow withholdings.

NSF Fee: In the event of a payment being returned from the bank for non-sufficient funds, any associated fees may be recorded in NSF Fee. NSF checks result in the need for an adjusting entry to reverse the payment as it was originally recorded. It is not advised that NSF fee field be completed as part of the adjusting entry. The program is not designed to “accrue” NSF fees. When the next valid payment is made, entering the fee at that time will result in reducing the portion of the payment going to principal by the amount of the fee.

Other #1 & #2: If any other types of deductions are to be withheld from the payment, it may be entered in these miscellaneous fields.

12.Principal and New Balance

Principal: This field is calculated automatically based on the activity type and the activity amount.

Disbursements result in an increase to the loan balance, based entirely on the amount entered in Activity Total.

Repayments usually result in a decrease to the loan balance, derived by subtracting interest (both current and collected accrued) and fees from the activity total. Remaining funds are used to decrease the loan balance.

Although “principal” may not be edited, it can be altered by editing the amounts within other fields.

Important Note regarding Repayments: In rare situations, especially when fees are attached to a repayment, a negative amount may appear within principal. This negative amount will increase the loan balance. Prior to saving the entry, review all fields for accuracy. It may be necessary to adjust fees or accrued interest to avoid a negative amount in principal. Adjusting entries, especially those recording NSF checks, will sometimes result in negative principal.

New Balance: If activity type is Disbursement, the amount in principal is added to the last balance to create a new balance.

If activity type is Repayment, the amount in principal is subtracted from the “last balance” to create a new balance.

13.New Paid-thru Date & Next Payment Due

The information within these fields will vary based on the type of activity.

Disbursement: new paid-thru date will default to the activity date if this is the first disbursement entered for this loan. If activity has previously been recorded, this will default to the paid-thru date of the last activity entered.

Repayment: if the activity being recorded is the first payment, the field will default to the date entered in the Loan Master file under “first due date” If the Loan Master field is blank, the new paid-thru date will default to the activity date and may be edited if desired. Subsequent repayments will result in the “new paid-thru date” automatically completed with the “next payment due” date as recorded on the most recent repayment.

Escrow: new paid-thru date will default to the paid-thru date of the last activity entered.

The New Paid Thru Date: This field can be edited if necessary.

Next Payment Due: This field should be considered an accompanying field to New Paid-thru Date. When funds are initially disbursed, this field will be completed automatically with the “first due date” from the Loan Master. If that field is blank, the next payment due should be entered manually as the date the next payment is expected.

When the first repayment is recorded, next payment due will advance to one payment cycle beyond the new paid-thru date. As subsequent repayments are entered, the field will continue to advance based on the next payment due as recorded in the previous activity and the payment frequency found within the Loan Master file.

Important Note: This field is essential to accurate calculations on delinquency and aging reports, and should be carefully reviewed prior to saving the entry, and edited as necessary.

14.Notes

This field is used to document activity and becomes part of the Loan History when displayed.

Note: When entering an activity that includes an amount in the Activity Total box, but this activity does not impact your cash account, it is recommended the words "non-cash", "non cash" or "noncash", be entered in the Notes section. When printing your Monthly Activity Report, you may then select to "Include Non-Cash Activity" which will cause an additional Totals line for this non-cash activity to print on the Summary page to aid in reconciling and/or editing your month-end general journal entry.

Should you discover after you have saved an activity that the New Paid Thru Date, Next Payment Due, or Notes need editing, this may be done using Tools, Build History.

15. Adjustments

The adjustment button should be used in situations in which the user needs to control the interest and fee amounts. In routine entries, the program calculates these fields automatically, but when Adjustment is selected, the program will only calculate principal automatically, based on the information entered by the user.

NSF checks are the most common reason for adjusting entries. GMS recommends that users continue to use adjustments to reverse NSF payments in order to create an audit trail. Even though the entry can be deleted, using an adjustment will show that the payment was made, then returned by the financial institution.

Remember: When reversing a payment, ALWAYS use the date of the last good activity. To determine what that date is, while in Loan Activity, select the correct loan, then click on the Print icon and print out the Loan Activity History. If the most recent activity is the activity needing to be reversed, find the date of the activity just before the activity about to be reversed. If that activity is good and doesn’t need to be reversed, then that date is the date to use to reverse the current activity. Remember to also use the New Paid-Thru Date from that activity as well as the Next Payment Due Date. Please see the example below.

D = Disbursement: used to record disbursements of loan funds.

R = Repayment: used to record repayments from the borrower

E = Escrow: used to record escrow payouts on behalf of the loan

7.Days Elapsed

An automatic calculation of days that have passed since the Activity Date as it was recorded in the most recent activity. The calculation is derived by using the activity date as entered and comparing it to the activity date on the most recently recorded transaction. This field cannot be edited. If Days Elapsed seems inaccurate, verify the activity date is entered correctly. The field just below Days Elapsed is Last Activity and will show the date of the most recently recorded transaction.

8.Last Activity, Paid-Thru Date, Balance, Accrued Interest, Regular Payment and Interest Type (Daily/Amortized)

These fields cannot be edited as they reflect the activity from the most recently recorded transaction.

Last Activity: Activity date of the most recently recorded transaction.

Last Pd-Thru Date: The Paid-Thru date recorded in the most recent transaction.

Last Balance: The Loan Balance as of the most recently recorded transaction.

Last Acc’d Int: The total outstanding Accrued Interest as of the most recently recorded transaction.

Regular Pmt: The total Loan Payment, including Escrows and Service Fees as recorded in Loan Master.

Daily/Amortized: The method of interest calculation as entered in the Loan Master for the selected loan.

9.Activity Total

Enter the total amount of the disbursement, repayment, or escrow payout. Unless an adjusting entry is being made, Disbursements and Repayments are entered as positive numbers. (Please refer to Things You Should Know for information regarding adjusting entries.) Escrow payouts are entered as negative numbers under both Activity Total and the appropriate escrow field and should have no impact on the loan balance.

10.Current Interest and Accrued Interest

Current Interest:

An automatic calculation made in one of the following two ways:

Daily Interest Loans: If the loan has been established as Daily Interest within the Loan Master file, Current Interest is determined by multiplying the loan balance by the annual interest rate, dividing that amount by either 360 or 365 days (as documented in Loan Master) to determine a daily interest rate. The daily interest rate is multiplied by the Days Elapsed to determine the amount of Current Interest to be withheld from the repayment.

Amortized Loans: If the loan has been established as Amortized within the Loan Master file, Current Interest is determined by multiplying the loan balance by the annual interest rate, and dividing that amount by one payment cycle, usually one month. The payment cycle is determined by the entry made into “Payment Frequency” within the Loan Master.

Accrued Interest:

Accrued Interest is also an automatic calculation made by the program to account for interest due and uncollected as of the activity date.

Positive Accrued Interest results from one of the following situations:

- Loans with multiple disbursements: When a subsequent disbursement is recorded, the program will calculate interest due on the loan balance (as it is prior to this disbursement) as of the activity date. That interest due, or “accrued”, becomes part of the loan history. From the activity date forward, interest will calculate on the new, higher balance.

- Payments that are insufficient to cover “current interest”: In this situation, the program computes interest due beyond the payment amount and posts that outstanding interest as “accrued”.

- Repayments with an activity total of zero: When interest rates are variable, posting a zero repayment results in interest accruing through the activity date at the rate documented in the Loan Master file.

Negative Accrued Interest occurs when the program collects outstanding accrued interest from a payment.

11.Late Fee, Service Fee, Escrow 1 & 2, NSF Fee, Other

These fields are to record various fees described below:

Late Fee: This amount is generally set up in Loan Master and will be calculated automatically based on that setup. See Loan Master for a full explanation of how Late Fees are set up.

Service Fee: This field is used to record any service fee applicable to the loan. This field will be calculated automatically if the Loan Master contains information within the field titled “Service Fee”. The service fee may also be entered manually, and an automatic service fee may be overridden if desired.

Escrow #1 and #2: These fields are used to record escrow funds applicable to the loan. If activity type is Repayment, and either of these fields is set up within Loan Master, the program will include this amount in the payment calculation. An escrow may also be entered manually, and an automatic escrow may be overridden if desired. If activity type is Escrow, enter a negative amount equal to the Activity Total.

Important Note: Escrow 1 Amt and Escrow 2 Amt within the Loan Master file have accompanying fields related to the maximum to be collected. The program will allocate repayment funds to escrow until the maximum is reached. Funds will no longer be collected until there is an escrow payout resulting in a reduced escrow balance. In some situations, an escrow account may not have a limit. Leaving the “maximum” field blank within the Loan Master will result in perpetual escrow withholdings.

NSF Fee: In the event of a payment being returned from the bank for non-sufficient funds, any associated fees may be recorded in NSF Fee. NSF checks result in the need for an adjusting entry to reverse the payment as it was originally recorded. It is not advised that NSF fee field be completed as part of the adjusting entry. The program is not designed to “accrue” NSF fees. When the next valid payment is made, entering the fee at that time will result in reducing the portion of the payment going to principal by the amount of the fee.

Other #1 & #2: If any other types of deductions are to be withheld from the payment, it may be entered in these miscellaneous fields.

12.Principal and New Balance

Principal: This field is calculated automatically based on the activity type and the activity amount.

Disbursements result in an increase to the loan balance, based entirely on the amount entered in Activity Total.

Repayments usually result in a decrease to the loan balance, derived by subtracting interest (both current and collected accrued) and fees from the activity total. Remaining funds are used to decrease the loan balance.

Although “principal” may not be edited, it can be altered by editing the amounts within other fields.

Important Note regarding Repayments: In rare situations, especially when fees are attached to a repayment, a negative amount may appear within principal. This negative amount will increase the loan balance. Prior to saving the entry, review all fields for accuracy. It may be necessary to adjust fees or accrued interest to avoid a negative amount in principal. Adjusting entries, especially those recording NSF checks, will sometimes result in negative principal.

New Balance: If activity type is Disbursement, the amount in principal is added to the last balance to create a new balance.

If activity type is Repayment, the amount in principal is subtracted from the “last balance” to create a new balance.

13.New Paid-thru Date & Next Payment Due

The information within these fields will vary based on the type of activity.

Disbursement: new paid-thru date will default to the activity date if this is the first disbursement entered for this loan. If activity has previously been recorded, this will default to the paid-thru date of the last activity entered.

Repayment: if the activity being recorded is the first payment, the field will default to the date entered in the Loan Master file under “first due date” If the Loan Master field is blank, the new paid-thru date will default to the activity date and may be edited if desired. Subsequent repayments will result in the “new paid-thru date” automatically completed with the “next payment due” date as recorded on the most recent repayment.

Escrow: new paid-thru date will default to the paid-thru date of the last activity entered.

The New Paid Thru Date: This field can be edited if necessary.

Next Payment Due: This field should be considered an accompanying field to New Paid-thru Date. When funds are initially disbursed, this field will be completed automatically with the “first due date” from the Loan Master. If that field is blank, the next payment due should be entered manually as the date the next payment is expected.

When the first repayment is recorded, next payment due will advance to one payment cycle beyond the new paid-thru date. As subsequent repayments are entered, the field will continue to advance based on the next payment due as recorded in the previous activity and the payment frequency found within the Loan Master file.

Important Note: This field is essential to accurate calculations on delinquency and aging reports, and should be carefully reviewed prior to saving the entry, and edited as necessary.

14.Notes

This field is used to document activity and becomes part of the Loan History when displayed.

Note: When entering an activity that includes an amount in the Activity Total box, but this activity does not impact your cash account, it is recommended the words "non-cash", "non cash" or "noncash", be entered in the Notes section. When printing your Monthly Activity Report, you may then select to "Include Non-Cash Activity" which will cause an additional Totals line for this non-cash activity to print on the Summary page to aid in reconciling and/or editing your month-end general journal entry.

Should you discover after you have saved an activity that the New Paid Thru Date, Next Payment Due, or Notes need editing, this may be done using Tools, Build History.

15. Adjustments

The adjustment button should be used in situations in which the user needs to control the interest and fee amounts. In routine entries, the program calculates these fields automatically, but when Adjustment is selected, the program will only calculate principal automatically, based on the information entered by the user.

NSF checks are the most common reason for adjusting entries. GMS recommends that users continue to use adjustments to reverse NSF payments in order to create an audit trail. Even though the entry can be deleted, using an adjustment will show that the payment was made, then returned by the financial institution.

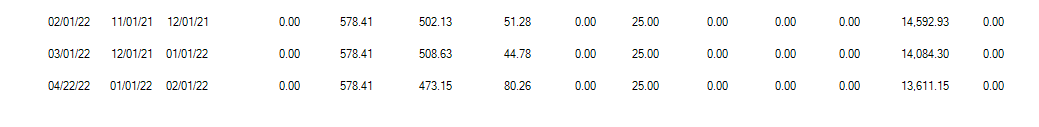

Remember: When reversing a payment, ALWAYS use the date of the last good activity. To determine what that date is, while in Loan Activity, select the correct loan, then click on the Print icon and print out the Loan Activity History. If the most recent activity is the activity needing to be reversed, find the date of the activity just before the activity about to be reversed. If that activity is good and doesn’t need to be reversed, then that date is the date to use to reverse the current activity. Remember to also use the New Paid-Thru Date from that activity as well as the Next Payment Due Date. Please see the example below.

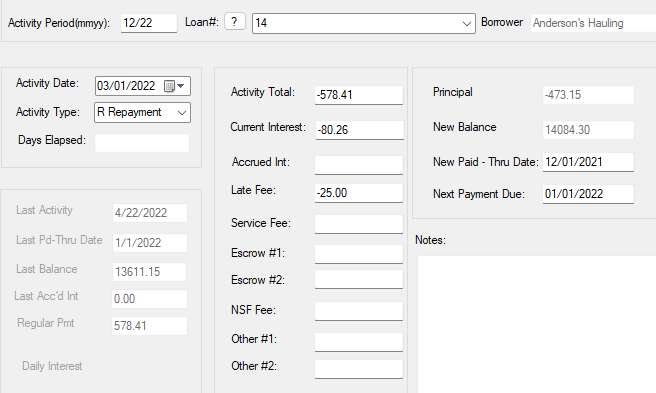

In this example, the 4/22/22 activity needs to be reversed. To determine the date to be used for reversal, refer to the last good activity. In this case, the 3/01/22 activity is good and does not need to be reversed, so it is the last good activity.

To reverse the 4/22/22 payment, select Adjustment, select the correct loan, then enter the date of 03/01/22, select Repayment. In Activity Total enter the total amount to be reversed as a negative amount: -578.41. In Current Interest, enter the interest amount as a negative: -80.26. There is also a Penalty (Late Fee) to reverse, so in the Late Fee field, enter -25.00. This will result in a negative Principal amount displayed in the upper right corner and the principal returns to the balance prior to the reversed payment. Make sure these amounts and dates are all correct before saving.

To reverse the 4/22/22 payment, select Adjustment, select the correct loan, then enter the date of 03/01/22, select Repayment. In Activity Total enter the total amount to be reversed as a negative amount: -578.41. In Current Interest, enter the interest amount as a negative: -80.26. There is also a Penalty (Late Fee) to reverse, so in the Late Fee field, enter -25.00. This will result in a negative Principal amount displayed in the upper right corner and the principal returns to the balance prior to the reversed payment. Make sure these amounts and dates are all correct before saving.

If the activity to be reversed is not the most recently recorded activity, it may be necessary to delete each subsequent payment made after the payment needing to be reversed. In the above example, if the payment needing to be reversed were the 03/01/22, then the 04/22/22 payment should be deleted, then the 03/01/22 payment reversed using the dates from the 02/01/22 payment, as that would then be the last good activity. Once the 03/01/22 payment is reversed, the 04/22/22 payment would be re-entered as it was entered originally.

Icons in Loan Activity

For a list of icons and descriptions found throughout GMS-RLSS please click here: Icons and Terms Within the GMS System

Icons in Loan Activity

For a list of icons and descriptions found throughout GMS-RLSS please click here: Icons and Terms Within the GMS System

Things You Should Know

- All entries must be saved in order to be recorded to the loan history and included in the Monthly Activity Report.

- Use caution when editing the Activity Period. It is sometimes necessary to post to the most recent period. For example, a repayment was received at the end of a month and needs to be posted within that month, so the Activity Period must be changed to reflect the prior month. If this occurs, a message will appear to verify the Activity Period.

- Try to always verify the Activity Period is correct as entered. The most common reason for activity not appearing in a Monthly Activity Report as anticipated is because it was entered into another period by mistake. If, for example, a repayment was received March 31, 2022, and you accidentally edit the period to 03/31 instead of 03/22, that activity will not appear in the Monthly Activity Report for 03/22.

- Activity Type determines what calculations the program applies to the entry. Make sure the correct Activity Type is selected.

- You may delete the last activity entered for a loan by using the red X, however, deleting is not always the best option. GMS recommends deleting activity that is incorrect – payment posted to the wrong loan, a typo in any of the amount fields, an incorrect date, etc. For payments returned for NSF, GMS recommends entering a reversal, as explained above.

- Regarding Escrows: Funds going into escrow accounts, when not part of a regular payment, are recorded as Repayments. This most often occurs when entering Escrow amounts as a lump sum. Regardless of whether the escrow funds are a part of a repayment or a lump sum, select Activity Type Repayment.

- A special note about lump sum payments to escrow: because the activity is recorded as a Repayment, the program will calculate current interest. Because lump sums are going directly to escrow, any interest should be accruing until a routine repayment is posted. Edit the entry so that the current interest as calculated by the program is in accrued interest. Then edit current interest to zero. This should result in zero to principal. When the next routine repayment is recorded, the accrued interest will be collected from that activity.

- Although Current Interest is available for editing, it is strongly advised the automatic calculations done by the program not be edited. Changing Current Interest can result in collecting too little or too much interest over the life of the loan.

- When entering an activity and before saving it, if you notice either the Activity Date or Activity Type is incorrect, when you change either of these fields, the amounts previously entered will clear from the screen, allowing you to begin entry again.

- At the bottom of your screen, you may see 1 or 2 messages. These are coming from either the Feature called Conversations or Supplement #829 Red Flag. The latest Conversation entered will appear if you have entered a specified number of months in the Screen Alert Setup tab of Conversations and the conversation falls within that timeframe. If you have purchased the Red Flag supplement and the loan you are viewing is determined to be “red flagged” according to the setup criteria selected, the Red Flag message will appear.