You are here: Supplements > EDA Report

EDA REPORT

|

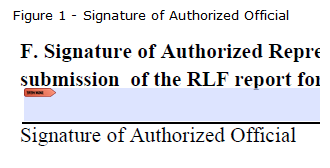

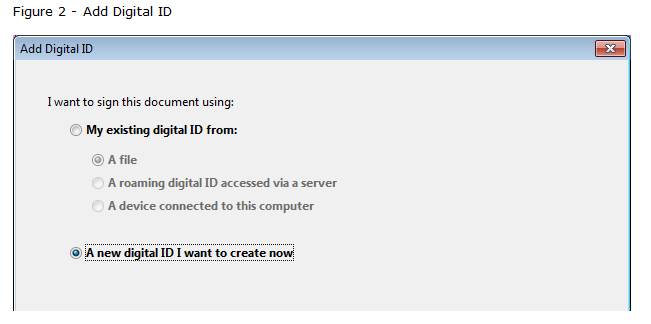

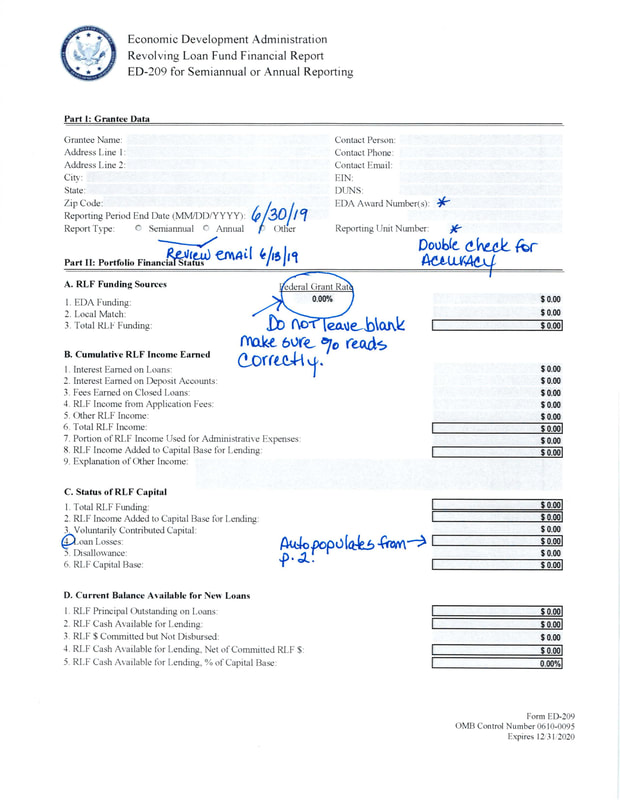

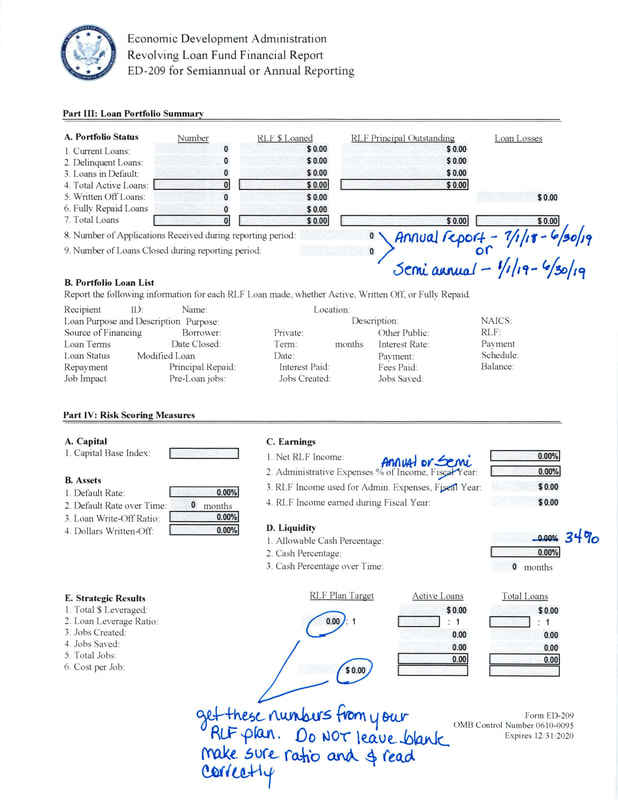

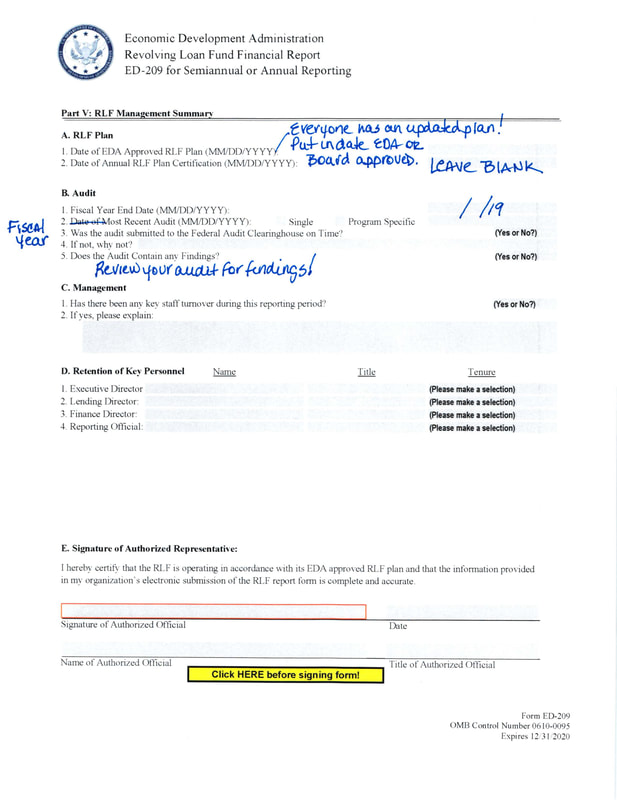

Function

Utilizing Excel to prepare a worksheet as of a specified cutoff date for a specific funding code to assist in EDA reporting requirements. Operating Instructions Grantee Name This will be automatically completed based upon your organization's setups. EDA Award No. Enter the Award # assigned to you by EDA for the loan fund you will be preparing the report for. Reporting Unit Enter your EDA Reporting Unit. DUNS Enter your DUNS number. Contact Person Enter the EDA contact person's name from your agency. Web Site URL: Enter your agency's website's URL Enter the email address for your agency's contact person. Selected Fund Select the appropriate fund from this combo box; only one fund may be selected for each report. Period Ending Select the ending date for the reporting period; only activity prior to or on this date will be included in the report. Click on the Printer icon to export your information into an Excel worksheet. You may enter external accounting data if you choose. Be sure to save your Excel worksheet under a different name each time such as EDA033113 or EDA093013 in a folder of your choice. This worksheet may then be used to enter information into EDA’s form. Special Icons View Previous Reports Allows retrieval of previously prepared and saved reports for quick review. Things You Should Know Within Loan Master files, there are many fields required to be completed in order to successfully report to EDA: Status Be certain all of your EDA loans reflect the correct status. Any loans that your agency considers to be a bad debt should have the status changed to Write-off and the date this write-off is effective entered. A negative disbursement using the same effective date should also be entered thru Loan Activity Adjustments to bring the loan balance to zero. Additionally, be sure Completed loans have been changed to the Repaid status. Loan Type This field is used to determine how the loan is reported on the EDA Report by tracking Industrial, Commercial, and Service businesses, as well as Startup, Expansion, and Retention. If the code selected begins with a “C” (CE, CN, CR) it will be reported as Commercial. If the code selected begins with an “I” (IE, IN, IR) it will be reported as Industrial. If the code selected begins with an “S” (SE, SN, SR) it will be reported as Service. If the second character of the code is “N” it will be reported as Start Up. If the second character of the code is “E” it will be reported as Expansion. If the second character of the code is “R” it will be reported as Retention. Jobs Actual jobs PreLoan/Retained and New must be completed. Funding Usage Working Capital and/or Fixed Assets must be completed and total 100%. SIC/NAICS You must have either a 4-digit SIC code or 5-digit NAICS code entered. Borrower Name EDA recommends never changing a Borrower’s Name once a loan has been uploaded to their system as a unique record is created based upon Borrower Name, RLF dollars and Loan Closing Date. Loans are considered by EDA to be Delinquent if they are 30-89 days past due. They are considered to be In Default if 90 or more days past due. It is not necessary for you to change the loan Status within the Loan Master to either Delinquent or Default. We will compare the cutoff date you’ve entered against the Next Pay Due field for each of your EDA loans and report on the appropriate line. If your loan(s) are multi-funded, the fund(s) not selected for this report will appear in the Other Public Funds line. Principal, Interest, Total Fees, Default, Deferred, and Write-off Amounts along with Loan Types will be pro-rated accordingly. “Other RLF Income” will show any amounts entered thru Loan Activity into the Other #1 or Other #2 fields. “Fees Earned on Closed Loans” will include Late Fees, Service Fees, and NSF Fees from Loan Activity. Beginning with the reporting period ending 09/30/10, all loans must have an NAICS code. SIC code will no longer be acceptable for new loans. In order to use this supplement, you must have Microsoft Excel 2000 or higher installed on the workstation. Microsoft Excel skills are recommended in case you find a need to edit the file. Saving, naming, and retrieving the report is at your discretion. You will determine which folder to save the files in, and also the name. To make the files easily accessible, we recommend always saving to the same folder. We also recommend file names that are easily recognized, such as EDA093012, EDA033112, etc., but the final decision rests with you. Active status will be reported as Current status. Active loans that are determined to be Delinquent (30-89 days late) or In Default (=>90 days late) will automatically be assigned to the appropriate line also. Loans in which you have changed the status in your Loan Master to Delinquent or Default will not have their status changed so you should review your Loan Master files to make certain the status is correct. This is a worksheet to assist you in preparing your EDA report. Use care in confirming amounts before finalizing. It is your choice to enter your accounting information into this worksheet or to wait to enter directly into EDA’s form. Should EDA require a profile of your loans, we recommend using Borrower Profiles found on your Reports menu. If you use the GMS Accounting software and are required to complete ED-209I, you will find that our supplement R&E Report Designer prepared in Aggregate using Cost Categories will help you quickly obtain the information required. REPORTING TIPS FOR COMPLETION OF RLF REPORT FOR EDA-FUNDED REVOLVING LOAN FUND GRANTS AWARDS These reporting tips are provided to support completion of ED-209: Revolving Loan Fund Financial Report (Report). The Report should be completed by entering the values in the form’s fields; responding to questions; and, verifying automatically calculated values. When applicable, the formula used to generate an automatically calculated value is provided in this document. For the purpose of these reporting tips, the Report fields are referenced by Part, Section, and Line, for example “III.B.6.” refers to Part III, Section B, Line 6 – “Total RLF Income”. (“Release Notes” accompany the ED-209 and ED-209I reports that specify technical requirements and tips to prepare and submit the Report.) The two semi-annual reporting periods are October 1 – March 31 and April 1 – September 30. All reported data are to reflect the status of the RLF as of the final day of the reporting period based on the activity during the period and cumulative over the life of the RLF, unless noted otherwise. The semi-annual report must be received by EDA on or before the end of the month following the reporting period end date (i.e. April 30th or October 31st, according to the reporting period). The report cannot be electronically signed without entering accurate information in fields with red borders; therefore, the report may not be accepted by EDA without confirming accuracy of those fields. Fields with a black border indicate an automatically calculated value. GRANTEE DATA Enter the applicable organization and contact information. Ensure that EIN, DUNS, EDA Award Number(s), and Reporting Unit [RUN] match EDA Award documents for the RLF grant(s). Reporting Period: The forms ED-209 and ED-209I, Version 4.6, require that the reporting period be selected from a dropdown menu. (This also allows the same form to be used to make corrections to a report for a prior reporting period.) PART I: PORTFOLIO STATUS No. [Number]: Entries in this column report the number of loans according to the loan repayment status as described below. RLF $ Loaned [RLF dollars loaned]: Entries in this column report the aggregate amount of RLF-funded loans (EDA award and local match funds) according to the status of the loan terms and payment schedule. RLF $ Loaned is the loan amount shown on the promissory note; do not include financing provided by other lenders in this field. RLF Principal Outstanding: Entries in this column report the aggregate balance of unpaid principal remaining on those RLF-funded loans. This field is not relevant for “written off loans” and would generally not apply to "fully repaid loans”. Loan Losses: This field reports the principal balance outstanding on the written off loan or the actual amount lost, whichever is smaller. This field is not relevant for “current loans”, “delinquent loans”, “in default loans”, “total active loans”, or “fully repaid loans”. I.1. Current Loans: Current loans are considered those in which payments are being made in agreement with the payment schedule. Do not include approved loans that have not been closed as of the reporting period end date. I.2. Delinquent Loans: Loans are considered delinquent according to the terms set forth in the RLF Recipient’s EDA approved RLF Plan and loan agreement. Typically, a delinquent loan is defined as one that is up to 90 days past due. If a previously delinquent borrower is now current, or making payments in accordance with an amended note and payment schedule, this loan can be shown as “current”. I.3. In Default Loans: Loans are considered in default according to the terms set forth in the RLF Recipient’s EDA approved RLF Plan and loan agreement. Typically, a loan in default is defined as one that is over 90 days past due but not written off. If a previously defaulted loan has been rewritten and/or the borrower is now current, the loan can be shown as current. I.4. Total Active Loans: Total active loans are loans in repayment status that are either current, delinquent or in default - exclusive of loans that have been fully repaid or written off. Fields for “total active loans” are auto-populated to report the aggregate of figures for total active loans, as of the reporting period end date. I.5. Fully Repaid Loans: Fully repaid loans have met the payment terms of loan and are not considered active. Note: Review individual loan records and appropriately document any amount that differs from $0.00. I.6. Written Off Loans: Typically a loan is defined as written off when collection options have been exhausted and the outstanding principal is recorded as lost bad debt. If a borrower has begun making payments on a previously written off loan; the Recipient has a current payment agreement on file; and the borrower is making payments in accordance to that agreement, the loan can be categorized as an active loan according to the status described above, possibly current. Note: “Loan losses” field should report the principal balance outstanding on the written off loan or the actual amount lost that was written off after pursuing collections, whichever is smaller. I.7. Total Loans: These auto-populated fields reflect the cumulative sum of all RLF loans made, whether active, fully repaid, or written off. PART II: PORTFOLIO SUMMARY Refer to the definitions below when completing sections in Part II. Total Loans, as described above (I.7), include all RLF loans made, whether active, fully repaid, or written off. Figures in this column report the cumulative sum of data for Total loans since the RLF grant was awarded. Active Loans, as described above (I.4), include all loans in repayment status, whether current, delinquent, or in default not loans that are fully repaid or written off. Figures in this column report the sum of data for active loans. Section A. Summary of Loan Activities II.A.1. Number of RLF Loans: This auto-populated field reports the cumulative sum of loans as reported in I.7 for Total Loans and I.4. for Total Active Loans. II.A.2. RLF $ Loaned: This auto-populated field reports that total sum of RLF $ Loaned as reported in I.7. for Total Loans and I.4. for Total Active Loans. II.A.3. Private Non-RLF $ Leveraged by RLF: This field reports the amount of private (non-RLF) funds leveraged for RLF loans. Typically, Private non-RLF $ are considered funds from financial institutions associated with the loan and the borrower’s own funds. II.A.4. Other Non-RLF $ Leveraged by RLF: This field reports the amount of private (non-RLF) funds leveraged for RLF loans. Typically, Other Non-RLF $ are considered any other investments leveraged by the RLF loan including other public financing (e.g., HUD-CDBG, USDA-IRP loans, etc.). II.A.5. Total $ Leveraged: This field reports the sum of lines II.A.3. and II.A.4. II.A.6. Total Project Financing: This field reports the sum of lines I.A.2. and II.A.5. II.A.7. Private Sector Jobs Created: The information entered on this line should indicate the actual number of jobs created. A job is counted as "created” if it was created as a result of and attributable to the RLF loan project, and has been verified by the borrower as actually created. Jobs are verified by requesting the borrower to complete a questionnaire at least on an annual basis indicating the number of jobs actually created and attributable to the RLF project; or by the grantee performing an on-site job count. The documentation for job counts should be placed in the project files. Created jobs may be credited if the jobs were created within five years of loan disbursement or, if construction is involved, within five years after construction completion. All jobs credited must be attributable to the RLF project. A created job must be removed from the credited created jobs if the job fails to last at least 18 months. Any job which meets the creditable job created criteria is counted as part of the total actual jobs created permanently, regardless of the status of the loan. For loans that have been paid in full, grantees may use the job information data that is on file provided there is adequate confidence in the reliability of the data. If there is a question on the reliability, the data should be verified by the next reporting period. An exception to this is any job that was created or saved and subsequently lost. For example, if an RLF borrower subsequently ceases business (or closes a segment of its business) thereby eliminating jobs previously counted as created or saved, these jobs may continue to be counted in the report only if they were maintained for a minimum of 18 months prior to the loss. In tallying jobs, only permanent and direct jobs may be counted; part-time jobs should be converted to full-time equivalents (by summing the total hours worked per week for all part-time employees and dividing by the standard hourly work week for full-time employees, normally 35-40 hours). Job information data should be collected at least annually. For seasonal businesses, more frequent collection of job data is usually necessary to obtain realistic employment figures for an annualized average. II.A.8. Private Sector Jobs Saved: The information entered on this line should indicate the actual number of jobs saved. A job is considered saved when it can be documented that without the RLF assistance the existing job would have been lost. An exception to this is any job that was created or saved and subsequently lost. For example, if an RLF borrower subsequently ceases business (or closes a segment of its business) thereby eliminating jobs previously counted as created or saved, these jobs may continue to be counted in the Report only if they were maintained for a minimum of 18 months prior to the loss. II.A.9. Total Private Sector Jobs: This field reports the sum of lines II.A.7. and II.A.8. II.A.10. RLF $ Loaned for Fixed Assets: This field reports the amount of RLF funds loaned for the purchase, installation or construction of fixed assets. If a single RLF loan was used jointly for fixed asset and working capital purposes, only the fixed asset amount should be reported on this line. The report limits the use of funds for “Fixed Assets”, “Working Capital” or a combination of the two. II.A.11. RLF $ Loaned for Working Capital: This field reports the amount of RLF funds loaned for working capital purposes as defined by generally accepted accounting principles. Include on this line only the amount or portion of a RLF loan that was actually used for working capital purposes. II.A.12. RLF $ Loaned for Start-Up: This field reports the amount of RLF funds loaned for loans to start-up businesses. A Start-Up is a new business that has limited or no prior operating history. Note: The report requires the loan to be categorized for “Start-Up”, “Expansion”, or “Retention”. II.A.13. RLF $ Loaned for Expansion: This field reports the amount of RLF funds loaned for business expansion loans. An Expansion involves an existing company that will expand operations and create additional jobs. II.A.14. RLF $ Loaned for Retention: This field reports the amount of RLF funds loaned for business retention loans. A Retention is where existing jobs of the company are "saved" as a direct result of the RLF assistance and would otherwise be lost. II.A.15. RLF $ Loaned for Industrial: This field reports the amount of RLF funds loaned for Industrial projects. Industrial projects include manufacturing, agriculture, forestry, fishing, mining, and construction businesses – essentially businesses engaged in the production of a product. Note: The report requires the loan to be categorized for “Industrial”, “Commercial”, or “Service”. I.A.16. RLF $ Loaned for Commercial: This field reports the amount of RLF funds loaned for Commercial projects. Commercial projects include retail and wholesale trade businesses. II.A.17. RLF $ Loaned for Service: This field reports the amount of RLF funds loaned for Service projects. Service projects include businesses which provide a service to individuals or businesses, i.e., those not engaged in the production of a product or the sale of merchandise. Section B. Comparison of RLF Portfolio to RLF Plan To complete the fields in Part II.B, use your current EDA-approved RLF Plan to enter the applicable ratios and percentages in the first column (RLF Plan). Figures reported in Total Loans and Active Loans columns should be consistent with the definition above. II.B.1. Cost per Job: This field is auto-populated for Total Loans as .7., $ ÷ ..9. and for Active Loans as .4., $ ÷ ..9. II.B.2. Non-RLF Private Leverage Ratios: This field is auto-populated for Total Loans as..3.÷ .7., $ and for Active Loans as ..3.÷ .4., $ . Unless stipulated otherwise in the grant agreement, RLF loans must be used to leverage private investment of at least two dollars for every one dollar of RLF investment across the RLF Portfolio (synonymous with “Total Loans” in the ED-209). To be classified as leveraged, private investment must be made within twelve (12) months prior to approval of an RLF loan, as part of the same business development project, and may include: (1) capital invested by the borrower or others; (2) financing from private entities; and (3) the non-guaranteed portions and ninety (90) percent of the guaranteed portions of the U.S. Small Business Administration's 7(A) loans and 504 debenture loans. Private investments shall not include accrued equity in a borrower's assets. II.B.3. Non-RLF Private and Other Leverage Ratios: This field is auto-populated for Total Loans as..4.÷ .7., $ and for Active Loans as ..4.÷ .4., $ . II.B.4. % Working Capital Loans: This field reports the sum of the number of loans categorized as working capital divided by I.7., Number or I.4., Number, for Total Loans and Active Loans, respectively. II.B.5. % Loans for Start-Ups: This field reports the sum of the number of loans categorized as start-ups divided by I.7., Number or I.4., Number, for Total Loans and Active Loans, respectively. II.B.6. % Loans for Industrial: This field reports the sum of the number of loans categorized as industrial divided by I.7., Number or I.4., Number, for Total Loans and Active Loans, respectively. PART III: PORTFOLIO FINANCIAL STATUS Section A. RLF Funding Sources These figures will generally not change between reporting periods without an Amendment to Financial Assistance Award (CD-451). III.A.1. EDA Funding: This field reports the EDA grant amount or EDA share of the total allowable project cost, as reflected on the Financial Assistance Award (CD-450) or Amendment to Financial Assistance Award (CD-451). III.A.2. Local Match: This field reports the amount of non-Federal funds that were committed as local match and reflected on the Financial Assistance Award (CD-450) or Amendment to Financial Assistance Award (CD-451). III.A.3. Total Funding: This auto-populated field reports the sum of RLF Funding Sources as reported in lines III.A.1. and III.A.2. Section B. RLF Income Earned to Date III.B.1. Interest Earned on Loans: This field reports the cumulative amount of interest earned directly from repayment of individual RLF loans since the RLF grant was awarded. III.B.2. Interest Earned on Deposit Accounts: This field reports the cumulative amount of interest earned from the interest-bearing deposit account holding the RLF Capital Base funds. This amount does not include the Federal portion of interest earned on sequestered excess funds held in an interest bearing account. The Federal portion of that interest earned is reported in line IV.B. 6.; however, the RLF Recipient’s portion of sequestration interest is withdrawn from the account of sequestered funds, deposited to the RLF account, and included in line III.B.2. as account interest generated during the reporting period. III.B.3. RLF Income from Application Fees: This field reports the cumulative amount of fee income earned from unsuccessful loan applications that are turned down or withdrawn prior to loan closing and funding. In cases where the RLF returns the fees to the applicant prior to the end of the reporting period, the amount would not be reported. III.B.4. Other RLF Income: This field reports the cumulative amount of any other income related to RLF loan portfolio not otherwise reported in section III.B. For example, in the case that sale of collateral exceeds the amount bad debt written off, the difference would be included here as income to the RLF. III.B.5. Fees Earned on Closed Loans: This field reports the cumulative amount of all fee income earned from individual loans that have been closed and funded, including application fees, origination fees, loan servicing fees, late payment penalties, and any addition fees assessed to RLF loans. III.B.6. Total RLF Income: This auto-populated field reports the gross sum of Total RLF Income as reported in section III.B. Note: RLF Income excludes loan principal repaid, value of recovered collateral (except as noted in the case for III.B.4), or and interest on sequestered funds remitted to the U.S. Treasury. III.B.7. Portion of RLF Income Used for Administrative Expenses: This field reports the cumulative amount of income that has been used for eligible and reasonable RLF administrative costs. Time cards shall be maintained for all direct labor costs charged against RLF income. If indirect costs are charged against the RLF, the Grantee must have a current indirect cost allocation plan. RLF administrative costs can only be reimbursed from RLF income earned in the same reporting period. RLF Income that is not used for administrative costs during the six-month Reporting Period is retained in the RLF account and made available for lending activities. III.B.8. RLF Income Added to Capital Base for Lending: This auto-populated field reports total RLF income less income used for administrative expenses, specifically ..6.− ..7. Section C. Status of RLF Capital III.C.1. Total RLF Funding: This auto-populated field reflects line III.A.3. III.C.2. RLF Income Added to RLF Capital Base for Lending: This auto-populated field reflects line III.B.8. III.C.3. Loan Losses: This auto-populated field reflects the bad debt reported on line I.6., Loan Losses. III.C.4 Disallowance: This field reports the amount of funding returned to the EDA, generally due to persistent sequestration of excess funds, which have been recovered from the RLF due to the noncompliance with the capital utilization standard. An amount in this field is supported by documentation showing the amount of Federal funds returned to the government and the accompanying grant amendment that memorializes the partial termination. This figure will continue to be reported in perpetuity on each report once the funds have been recovered. III.C.5 Voluntary Contributed Capital: This field reports additional matching funds committed to the RLF after the initial local match grant award commitment. Once committed, these funds must remain part of the RLF in perpetuity and cannot be removed from the RLF Capital Base without acceptable substitution. The Recipient must document, in writing, that the voluntary contributed capital funds have been added to the RLF. This documentation should address the amount and source of the voluntary capital contributions as well as acknowledge the Recipient’s understanding that the voluntary capital contributions, once committed, are part of the RLF Capital Base, in perpetuity. The contributed funds must adhere to all RLF program requirements, and are subject to all program requirements, including sequestration. III.C.6. Current RLF Capital Base: This auto-populated field reports the aggregate value of the RLF by summing the lines in section III.C., specifically ..1.+ ..2.+ ..3.− ..4.− ..5. Section D. Current Balance Available for New Loans III.D.1. RLF Principal Outstanding on Loans: This auto-populated field reflects line I.1., RLF Principal Outstanding. III.D.2. Current Balance Available for Lending: This auto-populated field reflects the amount of cash held in the RLF account, and is calculated as ..6.– ..1. This is the amount of RLF capital base available to make additional loans as of the end of the reporting period rather than the actual amount of cash in the bank at the time the report is submitted. Contact your RLF Administrator if line III.D.2. does reconcile with the account balance for the bank statement that coincides with the report period, March 31 or September 30. III.D.3. RLF $ Committed but Not Disbursed: This field reports the amount of the loans that have been closed in the period from the end of the reporting period until the submission of the report. For example, if a $60,000 loan was closed on April 2 (two days after the end of the reporting period) and the report is not submitted to EDA until April 30, the Recipient will report the $60,000 in this field. This reports the loan was not closed at the end of the reporting period but funding has been committed to fund the loan. On the subsequent semi-annual report for September 30, the $60,000 loan would be reported in Part I according to its loan repayment status at that point. III.D.4. Current Balance Available, Net of Committed RLF $: This auto-populated field reports the actual RLF balance available for comparison to the capital base and to ultimately determine the RLF’s capital utilization rate. Line III.D.4. is calculated as ..2.– ..3. III.D.5. Current Balance Available, as % of Capital Base: This auto-populated field reports the percent of the capital base that is available for lending, by the calculation: ..4.÷ ..6. From this field, the capital utilization rate of the RLF can be determined as the percentage, (1 – ..5). For RLFs whose capital base (III.C.6.) is less than $4,000,000, the capital utilization standard is 75 percent. For an RLF to meet the standard, line III.D.5. would be 25 percent or less (1 – 0.75). If the percentage reported for line III.D.5. is greater than 25 percent, the RLF is out of compliance with the capital utilization standard and may be required to sequester the excess RLF funds. For RLFs whose capital base (III.C.6.) is $4,000,000 to $8,000,000, the capital utilization standard is 80 percent; therefore, the RLF is out of compliance if line III.D.5 is reported as greater than 20 percent. For RLFs whose capital base (III.C.6.) is greater than $8,000,000, the capital utilization standard is 85 percent; therefore, the RLF is out of compliance if line III.D.5 is reported as greater than 15 percent. III.D.6. Balance Available, as % of Capital Base, for Previous Reporting Period: This manually entered field reports the percent of the capital base that was available for lending according to the previous report. The figure is required in the ED-209 and is helpful to quickly determine whether excess cash may be subject to sequestration. Enter the figure reported on Part III.D.5 on the previous period’s report. If the RLF is out of compliance with the capital utilization standard for two consecutive reporting periods, represented on lines III.D.5. and III.D.6, EDA may require the Recipient to sequester the excess RLF funds. Section IV.B. reports additional values related to excess cash and sequestration. PART IV: MISCELLANEOUS INFORMATION AND CERTIFICATION Section A. Recent Loan Activity IV.A.1. Number of Applications Received During Reporting Period: Enter the number of loan applications received during the six-month reporting period. IV.A.2. Number of Loans Closed During Reporting Period: Enter the number of loan closed during the six-month reporting period. Generally, the number of loans closed would not exceed the number of applications received except where the application was received in a prior reporting period. Section B. Capital Utilization IV.B.1. Amount of Excess Cash for Reporting Period: This field reports the amount of excess RLF funds as of the reporting period end date. Excess cash is the amount of the net Balance Available for Lending (III.D.4.) that exceeds the capital utilization threshold based on the capital utilization standard according to the size of the capital base, see explanations in III.D.5, above. Excess cash is calculated as: Step 1: III.C.6.x (1 - Capital Utilization Standard) = Capital Utilization threshold Step 2: III.D.4. - Capital Utilization threshold = IV.B.1 IV.B.2. Amount of Excess Cash Subject to Sequestration: This field reports the amount of RLF funds considered Excess Cash that is subject to sequestration. Sequestration may be required when Excess Cash persists for two consecutive reporting periods. However, sequestration is not required where excess cash is less than $5,000. As a quick reference, if III.D.5. and III.D.6. both exceed 25% (or 1 – Capital Utilization Standard, according to note in III.D.5), then the amount of excess cash is subject to sequestration in a (separate) interest-bearing account. The Federal portion of interest earned from these sequestered funds is remitted to the U.S. Treasury; the RLF portion is returned to the general RLF account and recorded as income – line III.B.2 of the ED-209. IV.B.3. Change in Excess Cash Subject to Sequestration: This field reports the increase or decrease in the amount of Excess Cash compared to the prior report. It is an indicator of whether excess cash and capital utilization are improving. IV.B.4. Amount Sequestered in a Separate Account, as Reported by Grantee: This field reports the amount of excess RLF funds that have been sequestered in a (separate) interest-bearing account, as of the reporting period end date. Separately, on a bi-annual basis, the RLF shall send to EDA evidence of sequestered funds and the calculation to determine the Federal portion of interest generated on sequestered funds. IV.B.5. Name of Bank in which Funds are Sequestered: Enter the name of the bank where sequestered funds are held. The account number and address are not needed for the ED-209 report. IV.B.6. Total Interest Remitted to EDA, as of End of Reporting Period: This field reports the amount of interest from sequestered excess RLF funds that has been remitted to the U.S. Treasury, as of the reporting period end date. This is the Federal portion of the interest generated on sequestered funds. Ensure that you have provided EDA with documentation of submission of this interest. Section C. Capital Utilization IV.C.1. RLF Income Earned During Reporting Period: This field reports the RLF Income generated during the reporting period, where section III.B. reports cumulative figures for income. Income includes interest earned on outstanding loan principal and RLF accounts holding RLF funds (excluding interest earned on sequestered excess funds), all fees and charges received by the RLF, and other income generated from RLF operations, for the reporting period. There is a comparable figure for RLF Income on the ED-209I. IV.C.2. RLF Income Used for Administrative Expenses During Reporting Period: This figure reports the amount of allowable costs for administering the RLF within the reporting period. This figure reports the RLF income earned only for the six -month reporting period and is not a cumulative amount. This figure should be the same as that reported as Total Expenses on the ED-209I. IV.C.3. % of RLF Income Used for Administrative Expenses During Reporting Period: This auto-populated field reports the total sum of Part IV: C. RLF Income and Expenses.2. RLF Income Used for Administrative Expenses During Reporting Period divided by Part IV: C. RLF Income and Expenses. 1. RLF Income Earned During Reporting Period. RLF Income may cover costs to administer the RLF, provided that the amount of expenses incurred does not exceed the amount of RLF income received during the same six-month reporting period. Recipients should always complete the Revolving Loan Fund Income and Expense Statement (ED-209I), but do not need to provide EDA with a copy of the associated ED-209I unless the percentage in Part IV: C. RLF Income and Expenses. 3. % of RLF Income Used for Administrative Expenses During Reporting Period is 50% or greater. If this percentage is 50% or more (or the expenses are more than $100,000), the Grantee must provide EDA with a copy of their ED-209I for the reporting period. Section D. Administration IV.D.1. Has there been any staff turnover during this reporting period? Yes/No IV.D.2. Record name, title, and RLF responsibilities of this staff member. IV.D.3. Date of most Recent Independent Audit: Enter the date of the most recent audit. IV.D.4. Type of Most Recent Independent Audit: Use the drop down box to select either Program Specific Audit or Single Audit. IV.D.5. Was the audit filed with the Federal Audit Clearinghouse on time? The audit shall be completed and the report submitted within the earlier of 30 days after receipt of the auditor's report(s), or nine months after the end of the audit period, unless a longer period is agreed to in advance by the Federal agency that provided the funding or a different period is specified in a program-specific audit guide. Section E. RLF Plan Certification Does the RLF’s governing board certify that the RLF is operating in accordance with its EDA-approved RLF Plan? The Grantee must manage its RLF in accordance with an EDA approved RLF Plan. The RLF Plan must serve as the Grantee’s internal operating tool and set out administrative procedures for operating the RLF consistent with “Prudent Lending Practices,” as defined in 13 C.F.R. § 307.8. It is recommended that the Board review the RLF Plan at least annually to ensure that they are administering the RLF in accordance with the Plan. An RLF Recipient must update its Plan as necessary in accordance with changing economic conditions in the Region; however, at a minimum, an RLF Recipient must submit an updated Plan to EDA every five years. Section F. Signature of Authorized Representative Report must be dated and digitally signed by the authorized representative who, as part of their duties, has the authority to sign such reports on behalf of the organization. Typically, the Authorized Representative is the Board President or Chairman, or Executive Director. In some cases, the Board may authorize another member of the organization, such as the RLF Administrator, to sign the report as part of their position authority level. In this case, the Recipient should provide EDA with a letter or resolution from the Board authorizing the other party to sign the report on behalf of the Board. The letter or resolution should address specifically what documents the party is authorized to sign and the period of time that this authority is in place. By signing the report, the Authorized Representative certifies to EDA that the information submitted on the report is complete and accurate to the best of their knowledge. EDA will not accept an unsigned report. APPENDIX A: Prompts for Creating & Using Digital Signatures These reporting tips are intended for users running Windows 7. If you are running a different version, you may see different dialog box and options. Before signing the Report, ensure all information reported is correct. At a minimum, the following fields must be complete:

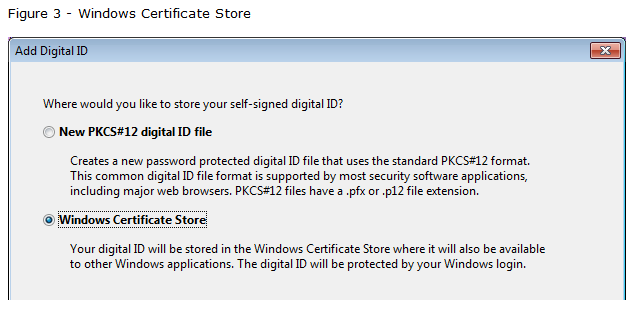

3. When the “Add Digital ID” dialog box appears, select “Windows Certificate Store” (see Figure 3).

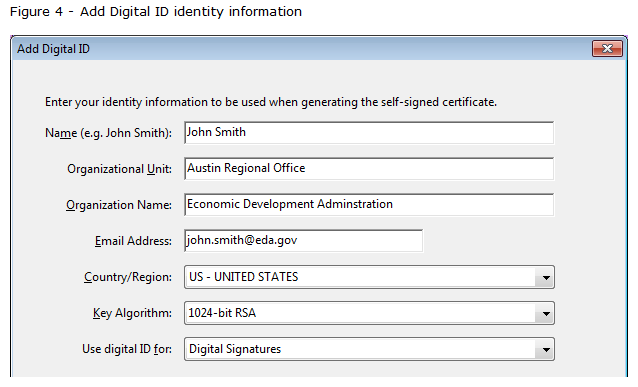

4. When prompted, enter the identifying information for the Authorized Official who will be signing the Report and select the following options (see Figure 4):

a. Key Algorithm: 1024- bit RSA b. Use digital ID for: Digital Signatures 5. Click the “Finish” button.

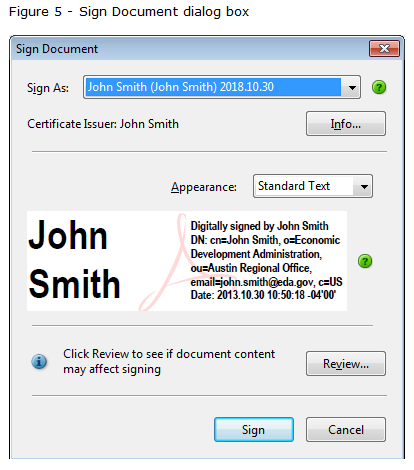

6. You will see a “Sign Document” dialog box (see Figure 5).

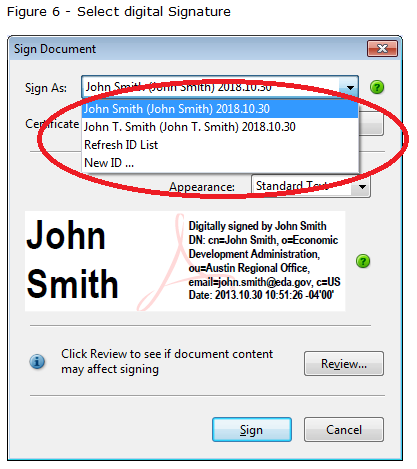

7. Use the “Sign As:” drop-down box to select a signature to use (see Figure 6). If you only have one signature, that signature will already be selected. If you want to create a new signature, select “New ID…” and follow steps 2 through 5, above.

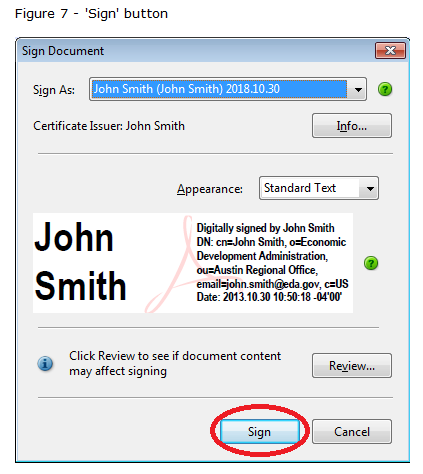

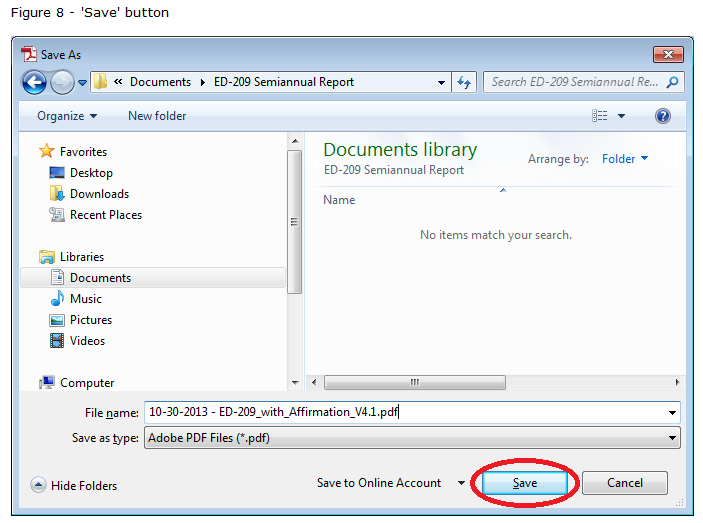

8. Click on the “Sign” button (see Figure 7). 9. Navigate to the folder of your choice and save the Report by clicking on the “Save” button (see Figure 8).

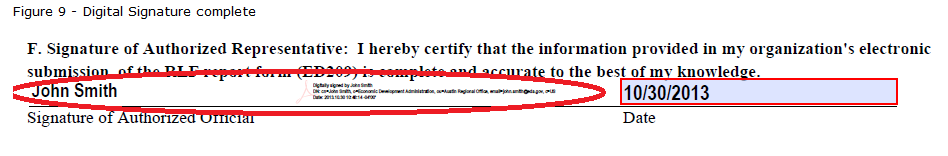

Note: You have the option of renaming the file prior to clicking “Save”. 10. The form has now been signed and the electronic signature will appear in the signature line (see Figure 9).

11. Remember to submit the form to EDA Regional Office by the deadline.

Tips for Successful RLF Reporting _____________________________________________________ The following document outlines common errors that were identified by EDA in previous RLF Reporting Periods that may be helpful to review and consider prior to submitting your next ED-209 or ED-209I form:

Please be sure to accurately fill out page 3, Part 4, Section A referring to the number of applications received and loans closed. (Generally, more applications should be received than loans closed.) Please double check the fields related to EDA Funding, Local Match, and Voluntary Contributions. Total Funding is a field that is automatically calculated on the basis of these three fields. Double-check Total Funding and if you notice an error, go back to fix the applicable field(s) within EDA Funding, Local Match, and Voluntary Contributions where the information is inaccurate. |

Most Common Errors